ezW2 is approved by the SSA for W2/1099 printing. It enables Black & White printing of forms W2 Copy A and W3 on plain paper, also supporting PDF printing and eFile features.

One of the most convenient things about ezW2 is that you can print all W2 and W3 forms on blank stock, and you can print 1099 recipient copies on blank paper. The software also supports a wide range of form types, including W2 Copy A (which you can print on a pre-printed red-ink form or an SSA-approved laser substitute), W2 Copy B (to be filed with the employee's federal income tax return), W2 Copy C (for the employee's personal records), W2 Copy D (for the employer), W2 Copy 1 (to be filed with the employee's state or local income tax return, if applicable), W2 Copy 2 (also for state or local income tax returns, if needed), and the laser W3 form for transmittal of wage and tax statements.

In addition to these forms, ezW2 can also prepare and print 1099 MISC Copy A for the Internal Revenue Service Center, 1099 MISC Copy B for the recipient, 1099 MISC Copy C for the payer, 1099 MISC Copy 1 for the state tax department, and 1099 MISC Copy 2 (to be filed with the recipient's state income tax return, if applicable).

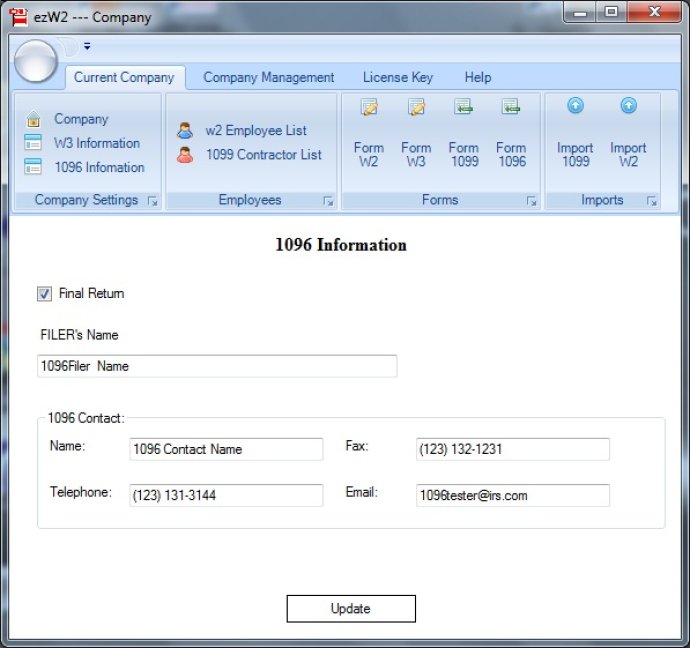

Other features of ezW2 include automatic calculation of transmittal totals for W3 and 1096 forms, support for an unlimited number of employees and recipients, the ability to print an unlimited number of W2 and 1099 forms, support for multiple companies, and easy import/export of data. And if you prefer PDF or e-filing, ezW2 has you covered there too. With just one click, you can print multiple forms, making this software a truly efficient and user-friendly solution for all of your W2, W3, 1099-misc, and 1096 needs.

Version 7.6.2: updated with 2019 forms