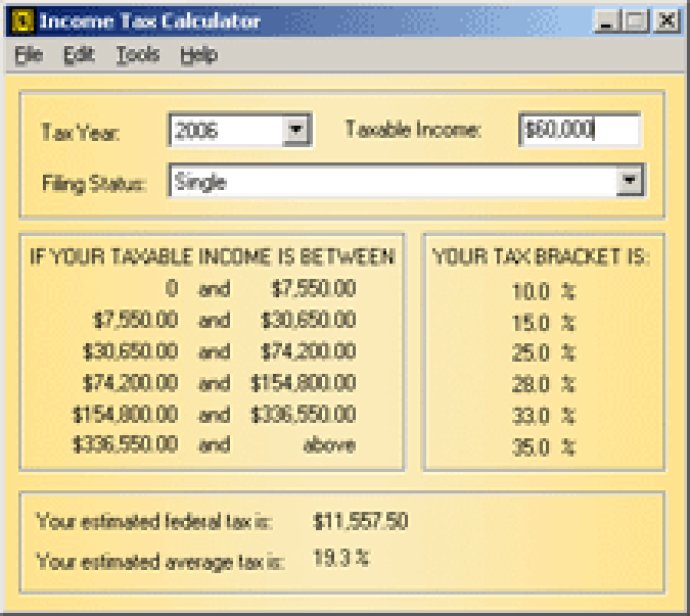

The Income Tax Calculator estimates federal tax for 2002-2016, displaying current and past tax brackets with filing status options. It computes average tax as a percentage of your total taxable income.

This tool is particularly helpful in showing you the percentage of tax that you'll need to pay on any additional income you earn. As your taxable income increases, your federal tax rate also increases. Therefore, if you earn an extra $1000 and find yourself in a 28% bracket, you'll need to pay an additional $280 in federal taxes.

What's more, the Income Tax Calculator provides a comprehensive overview of both current and past tax brackets, and can even estimate federal tax for years 2002-2016. The software includes an option for different filing statuses, ensuring that you get accurate tax estimates no matter your circumstances.

Finally, the calculator also shows your average tax rate—that is, the percentage of tax you would pay relative to your total taxable income. This makes it easy to plan ahead and budget for your upcoming tax payments. Overall, the Income Tax Calculator is a fantastic tool for anyone looking to take control of their tax estimates and ensure that they're always prepared for filing season.

Version 1.6: Added 2015-2016 income tax years tables