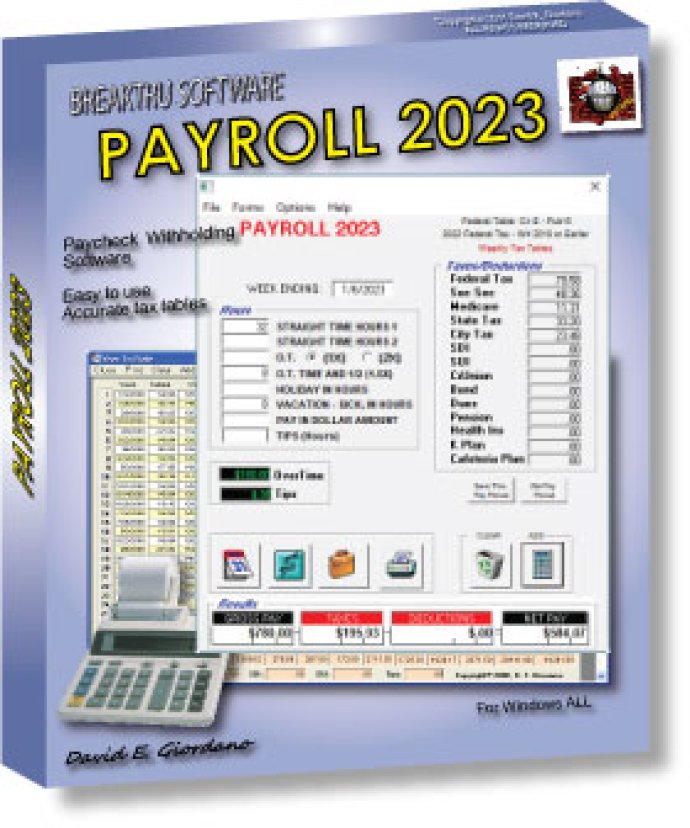

This payroll software is designed to calculate withholding taxes for small business payrolls. It enables printing of paychecks and year to date reports. Compatible only with Accounting USA, this software is suitable for small business owners.

One of the best features of Payroll Software is its ability to print paychecks directly from the software. Additionally, you can vary your K-plan deductions to find the percentage that works best for you. The software also allows you to track medicare, SDI, SUI, Cafeteria Plan and social security payments with ease. You can even print out year-to-date charts to see your earnings week-by-week, and these charts are updated with just a few clicks of the mouse.

The overtime chart is also a useful tool for tracking your earnings. It saves your last year's pay periods and calculates overtime percentage, which helps you stay within the company's limits. Payroll Software doesn't have any limitations when it comes to the number of employees you can use it for, and it's only available in the USA.

Overall, Payroll Software is an exceptional accounting tool for small businesses. It's undoubtedly the best, easiest and most affordable software on the market.

Version 19.1.0: New 2019 tax rates for Federal and State. Added additional state updates.