This software offers two modules for capital investment decisions, one for autos and one for other fixed assets. It provides reports on depreciation methods, maintenance options, and lease-buy-out scenarios for 72 periods.

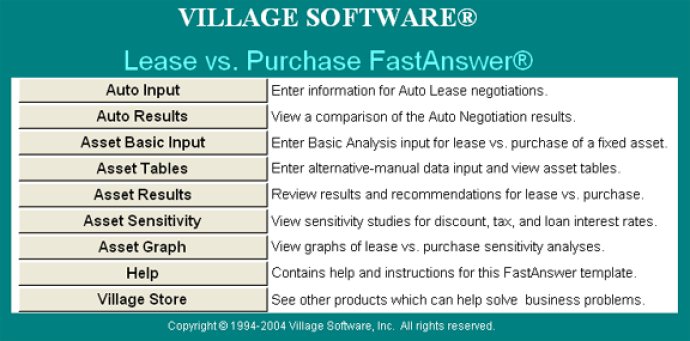

This product provides a comprehensive analysis of the financials of a lease vs. purchase. With insights into concepts such as depreciation, taxing, sensitivity, and more, Lease vs. Purchase offers users the tools to make the best decision when buying or leasing an asset or an automobile.

Designed by expert financial consultants with decades of experience in the field, Lease vs. Purchase's design is based on proven financial models used by thousands of successful business individuals.

Making the right capital investment decision can have a significant impact on your bottom line. Knowing when to lease or purchase an asset is crucial. That's where Lease vs. Purchase comes in. This software application offers two comprehensive modules that cover most every leasing scenario.

The first module offers analysis for capital assets of all varieties, from PCs to office buildings. With the ability to compare tradeoffs between leasing, purchasing outright, or purchasing with a loan, you'll be able to make an informed decision no matter what the asset.

The second module focuses specifically on automobile leasing and provides you with several decision support tools to help you negotiate your best leasing option.

With the ability to handle up to 72 financing periods, as well as cover depreciation and maintenance options, Lease vs. Purchase allows you to analyze costs, residual values, terms, and imbedded interest rates on auto leases.

Best of all, its user-friendly interface makes it easy to input and analyze your numbers. With Lease vs. Purchase, you'll determine the best financing option for your automobile or asset acquisition - without a whole lot of pain.

Version 5.0: N/A