This financial library offers the option to value prices, risk sensitivities, and implied volatility on a vast array of financial instruments, including bond options, interest rate assets, and exotic options within a customized software package for user convenience.

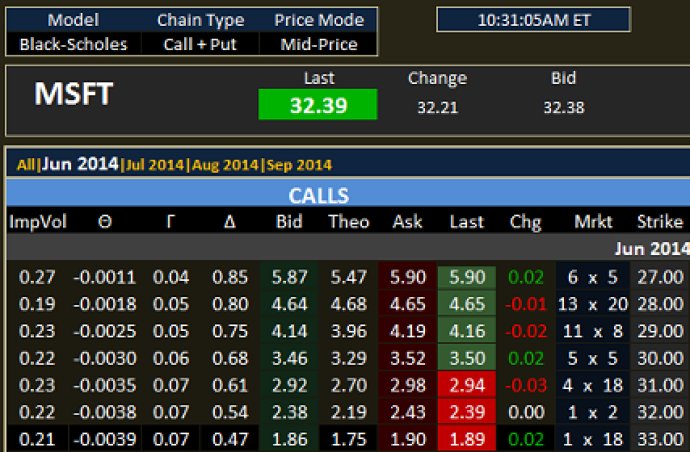

Using real-time market data from a quote vendor, the FinOptions API lets users value their portfolio positions, including sensitivities such as delta, gamma, theta, vega, rho, psi, and lambda. It can also calculate implied volatility values based on the prices of exchange-traded options. With over 60 optimized financial functions, the Derivicom FinOptions API analytics library ensures fast and easy-to-create business solutions.

It allows users to value option contracts on various assets like foreign exchange, fixed income securities, stocks, futures, indices, and Employee Stock Options (ESOs). Additionally, various exotic type contracts such as Barrier, Binary, Chooser, Compound, Currency-Translated, Lookback, Portfolio, Rainbow, and Spread options can be valued using the suite.

The suite provides complex interest rate and bond option pricing and analytics, historical volatility evaluation, and curve-fitting functions. It is a straightforward and easy-to-use COM compliant financial software library powered by an ultra-efficient processing engine, enabling users to analyze derivatives at lightning speeds regardless of dataset size.

The FinOptions API financial library is equipped with an intuitive object model and clear concise examples, making it easy to work with. It gives users the power to meet and exceed user expectations, quickly integrate advanced derivative analytics into their custom software solutions, and ultimately reach their business goals.

Version 3.0.1:

What's new in this version: Version 3.0:

Consolidation of FinExotics Dev and FinOptions Dev versions

Support for Interest Rate Options

Historic Volatility Calculations and Curve Fitting Support

Updated and Redesigned Help System

Product rebranded as FinOptions API