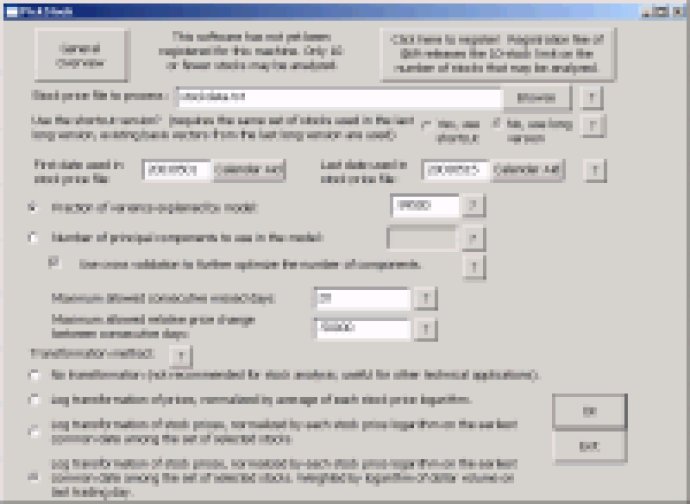

This software utilizes principal components analysis to find undervalued stocks by examining a user-provided database of past stock prices. It is based on the arbitrage pricing theory and designed to identify potentially underpriced stocks.

PickStock is an implementation of what is known in the financial modeling community as "arbitrage pricing theory." This theory suggests that changes in a vector of prices can be explained by a linear combination of economic components. While some economists debate the viability of this theory, PickStock offers a way to test it using real-world data.

This application is designed for users who can download stock price data and work with MetaStock text format. Moreover, if you have a strong understanding of how to handle text files and import them into spreadsheets, you'll find this software to be very intuitive.

The software is suitable for use by economists and stock analysts, who may combine it with more traditional methods of analyzing economic fundamentals. But PickStock isn't just for finance professionals. Scientists, engineers, and students can also make use of the powerful principal components analysis engine by replacing closing prices with arbitrary data. By associating a "date" with one experiment and using "tickers" to denote outputs, the "close" field can contain the corresponding output values.

Overall, PickStock is a great tool for anyone looking to gain insight into the stock market.

Version 1.7: Corrected errors in log transformation inversions and rejects.txt entries..